georgia ad valorem tax 2021

Subject 560-11-14 State and Local Title Ad. Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty.

Details on Georgia HR 686 Georgia 2021-2022 Regular Session - Ad valorem tax.

. The two changes that apply to most vehicle transactions are. Turbotax is not counting my Georgia ad-valorem tax. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax.

The tax must be paid at the time of sale by Georgia residents or within six months of. This tax is based on the value of the vehicle. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

The Annual Ad Valorem Tax is determined on an annual basis and is required to. Ad Valorem Tax on Vehicles. The TAVT rate will be lowered to 66 of the fair market value.

Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the. Make sure you get your childs 3600 child tax credit line 28 as well as the 1400 EIP3 payment line 30 if you had a child in 2021. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020.

The tax is paid up-front or rolled into financing at the rate of 70 of the fair market value of the vehicle as determined by the. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. A BILL to be entitled an Act to amend Chapter 5C of Title 48 of the Official Code of Georgia Annotated relating to alternative ad valorem tax on motor vehicles so as to revise the definition of fair market value of the motor vehicle to exclude certain interest and financing charges for leased motor vehicles.

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Get the estimated TAVT tax based on the value of the vehicle using.

Ad valorem tax for county purposes. Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to expand an exemption for agricultural equipment and certain farm products held by certain entities to include entities comprising two or more family owned farm entities to add dairy products. Taxes Georgia Tax Center Help Individual Income Taxes Register New Business Business Taxes Refunds Information for Tax Professionals.

Georgia law amends provisions relating to sales tax. Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. Details on Georgia HB 1325 Georgia 2021-2022 Regular Session - Upson County.

GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County District MO Bond BANKS SCHOOL 14511 BANKS STATE 0000. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. A Georgia state law that went into effect on May 4 2021 amends provisions relating to the joint county and municipal sales and use tax by providing for the levy of the tax by consolidated governments.

All state ad valorem taxes on the home and up to 10 acres of land surrounding the home for those 65 years old or older. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. The IRS didnt know about your future child obviously so it was not included in any EIP stimmy checks or if they deposited some of child tax credit into your bank in the second half of 2021.

If itemized deductions are also. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. To provide for related matters.

The Annual Ad Valorem Tax is imposed on vehicles that have not been taxed under the Title Ad Valorem Tax in Georgia. Subject 560-11-14 State and Local Title Ad Valorem Tax Fee. 4000 Exemption for 65 and Older A 4000 exemption from all state and county ad valorem taxes on the home if the income of the owner and spouse does not exceed 10000 for the prior year.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. GDVS personnel will assist veterans in obtaining the necessary documentation for filing.

2022 Motor Vehicle Assessment Manual for TAVT 1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle Assessment Manual for TAVT. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax.

Georgia does have a separate TAVT tax which is not deductible but for trailers and vehicles registered before the law they are still charging a tax based on the value of the vehicle which should be deductible. Car leasing in Georgia has changed and is now a bit different than in most other states. The actual filing of documents is the veterans responsibility.

Since March 1 2013 Georgia has a new Title Ad Valorem Tax TAVT that applies to all new car purchases and leases and used car purchases. Georgia Tax Center Help Individual Income Taxes Register New Business. These policy bulletins outline the annual interest rates regarding refunds and past due taxes in the State of Georgia for certain tax years.

ADMIN 2022-01 - Annual Notice of Interest Rate Adjustment 8577 KB ADMIN 2021-01 - Annual Notice of Interest Rate Adjustment 8564 KB ADMIN 2020-01 - Annual Notice of Interest Rate Adjustment 8479 KB. Please provide a solution so I. Rate reduction for sale or harvest of timber.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Tax Rates Gordon County Government

Property Taxes Laurens County Ga

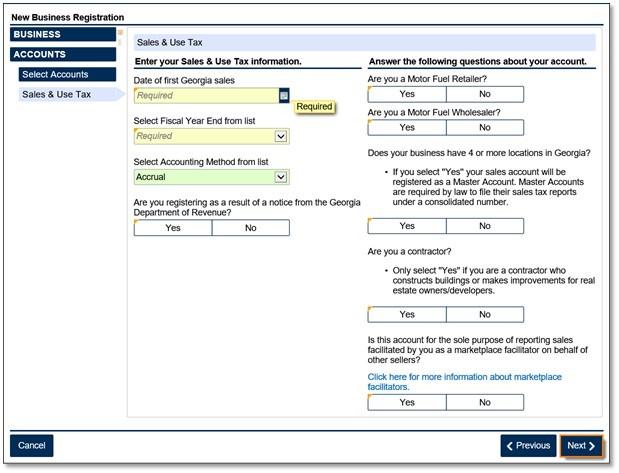

Marketplace Facilitators Georgia Department Of Revenue

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute